texas auto sales tax

For example if your sales tax. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

Form Mv 015 Download Fillable Pdf Or Fill Online Bill Of Sale To A Motor Vehicle Harris County Texas Templateroller

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

. Motor Vehicle Sales Rental and Use Tax. Using our Lease Calculator we find the monthly payment 59600. The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage.

A motor vehicle purchased in Texas for use exclusively outside Texas is exempt from motor vehicle sales tax. Local and county taxes are also applied to car sales. SaaS and basically anything involving information technology is a.

The use tax rate for the sale of a car in Texas is currently 625 of the price of the car for the 2023 calendar year. If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle. Motor Vehicle Local Sports and Community Venue District Tax for Short-Term Rentals.

Texas Sale Tax information registration support. Vehicle purchases are among the largest current sales in Texas which means they can result in a high sales tax bill. Texas has a 625 statewide sales tax rate but also.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. Motor Vehicle Sales and Use Tax. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

Motor vehicle sales tax is due. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local. 14-112 Texas Motor Vehicle SalesUse Tax Payment PDF 14-115 Texas Motor Vehicle Sales and Use Tax Report PDF For County Tax Assessor-Collector Use Only 14-116 Texas Motor Vehicle Sales and Use Tax Report Supplement PDF For County Tax Assessor-Collector Use Only 14-128 Texas Used Motor.

Some dealerships may charge a documentary fee of 125 dollars. For additional information see our Call Tips and Peak Schedule webpage. In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

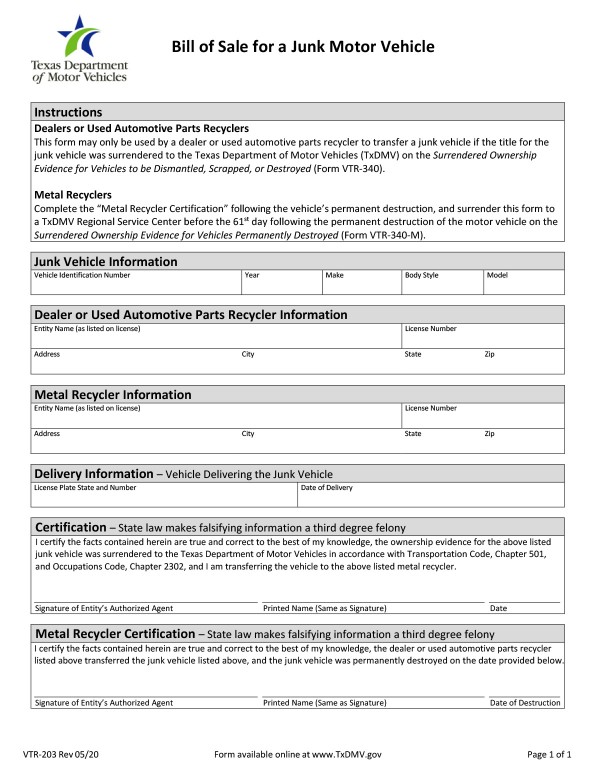

Motor Vehicle Texas Emissions Reduction Plan TERP Surcharge. TxDMV Form VTR-61 Rebuilt Vehicle Statement PDF indicates the seller performed the repairs. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. Again this is subject to change year to year. Fast Easy Tax Solutions.

The title applicant has purchased a repaired motor vehicle. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Texas has recent rate changes Thu Jul 01 2021. Ad New State Sales Tax Registration. Some states provide official vehicle registration fee calculators while others.

Texas has 2176 special sales tax jurisdictions with local. An example of items that are exempt from Texas sales tax. The tax is computed on the remaining selling price for the purchased.

With local taxes the total sales tax rate is between 6250 and 8250. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. To be eligible the trade-in must be taken as part of the same sales transaction and transferred directly to the seller.

For retail sales of new and used motor vehicles involving licensed motor vehicle dealers the motor vehicle sales tax is based on the sales price less any amount given for trade-in vehicle. Ad Find Out Sales Tax Rates For Free. In addition to taxes car purchases in Texas may be.

This page covers the most important aspects of Texas sales. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. The sales tax for cars in Texas is 625 of the final sales price.

The state sales tax rate in Texas is 6250. How to find affordable car insurance in Texas. Forms for Motor Vehicle Sales and Use Tax.

Motor Vehicle Seller-Financed Sales Tax. To claim the exemption a purchaser must not use the motor vehicle in. In most counties in Texas the title fee is around 33.

Texas has a statewide sales tax of 625 that applies to all car sales. Motor Vehicle Texas Emissions Reduction Plan TERP Registration Surcharge. Visit us today at our South location 16200 Hwy 3 Webster TX 77598 or our North locaton- 11655 North Fwy Houston TX 77060-our seasoned professionals are ready to answer any.

Tax is calculated on the leasing companys purchase price.

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To Gift A Car In Texas 500 Below Cars

Motor Vehicle Comal County Tax Office

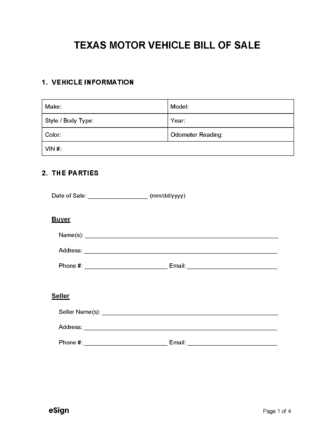

Free Texas Dmv Bill Of Sale Form For Motor Vehicle Trailer Or Boat Pdf

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Which U S States Charge Property Taxes For Cars Mansion Global

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Texas Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Texas Motor Vehicle Bill Of Sale Form Pdf Word

Texas Used Car Sales Tax And Fees

Free Harris County Texas Bill Of Sale Form Pdf Word Doc

Texas Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Texas Bill Of Sale Form Templates For Car Boat Fill Out And Download