trader tax cpa cost

Videos view all videos. As a small day trading business Trader Tax Pros has been the perfect find for all of our accounting needs and business advice and support.

Best Cryptocurrency Tax Software 2022 Guide To The Top Options

These include expenses for investment counseling and advice legal and accounting fees and.

. Let Us Help You Find an Expert You Can Trust With Your. GTT Trader Guides view all guides. Brian Rivera is an active trader entrepreneur Certified Public Accountant and owner of Trader Tax CPA LLC a leading firm specialized in providing tax compliance and preparation.

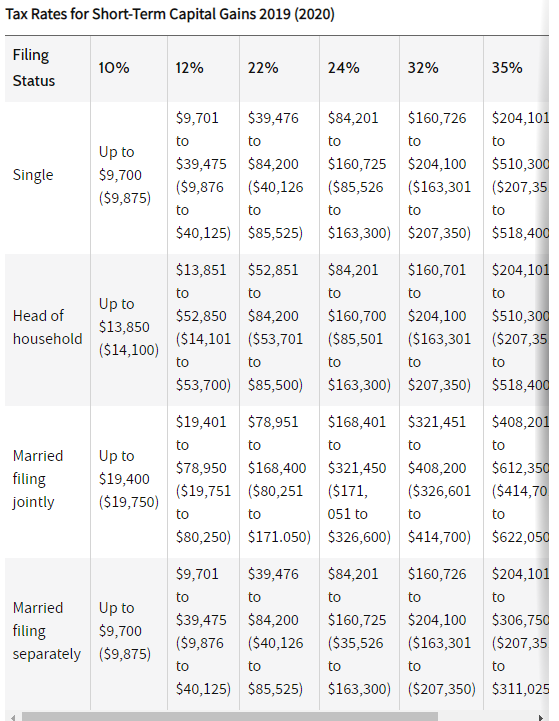

Why add one more to the mix and worry about. Jonathan Benanti Day Trader. The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 220 while the average.

Compensation for new contractors ranges from 55 to 80 per. Let Traders Accountings knowledgeable and experienced. Cynthia Young Day Trader.

Then there are all kinds of add. The other 600 is your deposit toward our overall hourly fee of 200 an hour. Mark to market election is not subject to the wash.

For a simple sole trader business a tax return can cost between 300 and 500. Licensed CPA with continuing education requirements met. Trader Tax Services and Accounting.

For new clients we charge a 100 setup fee. Accountants for Active Day Trader Tax Planning Services. As previously described claiming trader status and mark to market election gives you the ability to reap certain tax benefits.

Our Sole Trader Accountant Costs start from 495. Right now their MINIMUM fee is 1750 for taxes. As a day trader you probably have a million and one things on your plate every day.

3 Tax Strategies to Save on Day Trading Taxes. For example choose to work 1000 billable hours. Ad Free price estimates for Accountants.

To give you an idea of the comparison of other professional accounting fees to that of a certified public accountant take a look at the averages below. Investors can generally deduct the expenses of producing taxable investment income. Green Trader definitely seems knowledgeable i just wonder if the fees are worth it.

Greens 2022 Trader Tax Guide The Savvy Traders Guide To 2021 Tax Preparation 2022 Tax Planning Buy Now.

Green S 2021 Trader Tax Guide Available Now Green Trader Tax

Trader Tax Corner Trader Tax Cpa Llc

Trader Tax Corner Trader Tax Cpa Llc

Mark To Market Accounting Pro Trader Tax

Trader Vs Investor Mtm Election Trader Taxes Akram

Trader Accounting Trader Tax Cpa Llc

Trader Tax Corner Trader Tax Cpa Llc

Tax Planning My Investing Club

Day Trading Taxes Guide For Day Traders

Day Trader Tax Guide For Securities Traders Inglese Cpa Chris

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

Trader Tax Explained Ft Brian Rivera Youtube

Traders In Securities Financial Services Accounting Pasadena Cpa Firm

Solved Will Turbo Tax Work If I Am A Full Time Trader In Commodities Self Employed Formed A Sole Proprietorship Llc In May And Elected Mark To Market Irc 475 Accounting

Day Trading Don T Forget About Taxes Wealthfront

Becoming Eligible For The Trader Tax Status Tax Professionals Member Article By Lloyd J Cazes Cpa